Why is the Roi of a Harvesting Tractor Easy to Calculate

With each new product launch and update, farm equipment is becoming more sophisticated. As the equipment you're selling becomes more complex, so does your approach to selling it. While there has been some positive news recently with crop prices and net farm income improving, a recent poll by Progressive Farmer shows that 53% of farmers say equipment and technology strain their financial resources.

But, if approached correctly the way you sell customers equipment or technology could ease their worries. That's where using return on investment (ROI) can help.

Today's sales conversations need to move beyond just trade difference and price, says Jon Carlo, director of sales at AgriVision Equipment (2020 Dealership of the Year), a 17-store John Deere dealership in Nebraska.

"If you look back, a lot of the selling skills required knowing the cost per hours and the trade difference, and whether [the customer] can actually afford it or not. And then there was an arm wrestling match that would take place and the salespeople either win, lose or draw," he says. "But what's missing from that picture is the focus on the bigger picture challenges our customers face. Today, we're seeing customers up against cashflow constraints. Balance sheet health is a big part of the conversation. Labor challenges is another.

"We're getting into bigger picture conversations and then what we're doing is tailoring a solution based on what customers' needs are. And oftentimes it's not just a single transaction. It's something that fits into the bigger picture."

The ROI conversation can come into play for something as seemingly small as twine vs. net wrap for bales to something as large as a combine purchase. The key is determining what numbers are important to the customer and using their own data and field information to show value.

Setting the Stage

Not every customer is going to be right for an ROI conversation, so that part of the discussion shouldn't come until after the salesperson has narrowed down the customer's needs, says Toby Groves, digital marketing manager at AGCO.

"You have to work back through the math. It's not what this technology costs. It's what it's worth…"

– Jeff Morgan, H&R Agri-Power

Groves worked on creating AGCO's Resource Center (ARC) app, which includes value calculators for a variety of product lines. He works with dealers on training them on the tool as well as what AGCO calls its precision selling process, which involves 8 steps.

"It starts with relationship building and discovery questions and narrowing it down, what's really most important to that operator," Groves says.

It's during that discovery portion of the sales process that you'll determine what the customer wants to accomplish, be it improved yields, efficiency, reducing input costs, etc.

Jeff Morgan, regional manager for H&R Agri-Power, a 17-store Case IH dealer based in Kentucky, agrees and says not every customer is the right fit for an ROI conversation. "Whenever you use return on investment tools, that means more to some operators than others. Impulsive buyers, it's not going to mean much to," he says.

"That's when you get into personality profiles. Obviously, I gravitate toward business people who look at analytical tools, but that is not a complete representation of everyone that buys equipment from us," Morgan says. "We get those knee-jerk buyers. They get in a mood and you better give them something quick, because once they sleep or have a meal … 30 minutes can make a big difference in how they're going to react. And you've got to know that customer. So all these tools that we have don't meet everyone's needs."

The more analytical customers will gravitate to the numbers you can show them with an ROI tool, but you need to determine what numbers are important to them. "Focus on the right number. Is your customer looking at a dollar per acre? I want to trade planters, but I want to trade planters for $9, $10, $15 an acre. There are rules of thumb out there for planter trades based on a per-acre cost," Morgan says.

You won't necessarily focus on the trade difference between what you're asking for the new unit and what you're allowing for the trade. "Take it all. What's your dollars per acre? Your customer may be focused on a payment or debt serviced," Morgan says. "He knows he can afford say $100,000 a year on his total equipment debt. Whatever that number is, we have to stay in their comfort zone. So we maybe focus on the debt service. The customer may be focused on trade history. Historically, we've always done this. And I traded every 3 years and it's cost me X amount."

Web-Exclusive Sidebar: Using ROI to Sell Customers on Strip-Till Management

For others, the numbers that matter might be interest rate and equity position, which Morgan says go hand in hand "Normally, we try to get our lowest interest rates within the trade cycle," he says. "We may set an equipment trade on a 5-, 6- or 7-year note knowing the customer will never take that note to maturity. We'll set it on a 3-year trade cycle because we want their best interest rate to be in those 3 years."

Maybe tax management is their issue, and therefore cashflow isn't a concern. "This is a different situation. Focus on the right number. It may not be payment driven. This may be a person who's cash flush," explains Morgan. "So, they're looking for a tool to maximize their tax advantage, which could be a lease. Not a cheap lease, but a lease where they can essentially write that investment off in 2-4 years rather than setting it up on a depreciation schedule of 5-7 years."

Morgan advises salespeople to be sure they are comparing like for like. For example, with all the upgrades that are available today, someone trading in a 3-year-old corn planter could have technology upgrades on the new planter of $100,000-$200,000.

"You've got to separate that. Yes, we're trading for $10 an acre and the components you're trading me, I'll trade with you for $10 an acre. However, these technology upgrades are another $10-15 an acre. You have to be sure to compare it like for like or they'll really get sticker shock because we're literally adding $2,000 or $3,000 per row unit in technology components."

Morgan says while a base model 24-row planter might cost about $240,000, there are a lot of 24-row planters that sell for $350,000 once all the technology upgrades are added. "You have to work back through the math. It's not what this technology costs. It's what it's worth," he says.

"Understanding the features and benefits of your products is super critical to be able to do ROI. You can't really do ROI and sell a commodity…"

– Jamie Gudeman, PrairieLand Partners

Jamie Gudeman, sales director for PrairieLand Partners, agrees on the importance of knowing your customers and what issues or numbers will be the most important to them. "It comes down to having a relationship with my customer and understanding his business and where he's going so I can pick what I'm going to put in front of him," he says.

"If it's a customer who's downsizing his farm and trying to slow things down, I'm not going to go after improving how fast he can plant and his technology. Then I can say, 'I understand that labor has been an issue for you. And so you're running two planters now.' How can I look at the technology that's out there, reduce your need for labor, because it's hard to come by and it's unreliable sometimes. Maybe, it doesn't get crop in when you need to, and therefore costs you more money because your yields are reduced."

Gudeman goes on to say you have to be part of the customer's inner circle and have a seat at the table to be able to craft a solution for them. "We haven't even talked about price yet. We're just helping them achieve their goals or solve their problems," he says. "How do we get a salesperson to do that? We don't talk in terms of price. We talk about who's growing in your area. Do you know that there's X many acres of corn being grown here vs. 10 years ago? That means our customers' farming habits are changing. What are some things we're going to do to accommodate that?"

Focus on Value

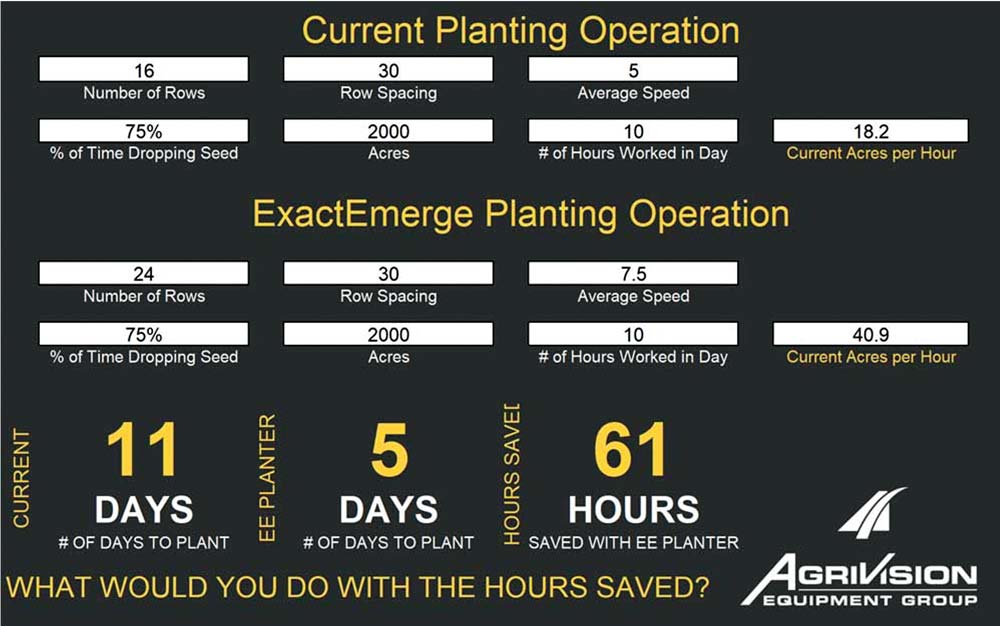

As equipment prices have climbed steadily over the last several years, focusing on the value and the customer's ROI is important. Carlo of AgriVision points to ExactEmerge planters as an example (see Fig. 1). "Those are some of the highest performing planters on the market today. And when you go to sell a customer based on what just the sale price is and what their trade in is worth, that's a real tough conversation. We leverage ROI calculators that show whether the advantage is 4, 6 or 8 bushels in real data that we've seen from our customers," he says. "Then we plug that into the calculator to show what that return looks like and over how many years.

Fig. 1: AgriVision Equipment's sales team focuses on using real, local data to show customers a product's return on investment. They developed an in-house ROI calculator for a number of products.Click to enlarge photo

"A lot of people would like to talk about the speed and efficiency side of those planters, so if we go from 5 to 7 mph, or 5 to 9 mph, and we're able to reduce the hours on our equipment, lower our labor costs, we factor all of that into the equation. It's a way that can help the customer break down that the value. The value isn't going to be determined in the trade difference. The value is going to be determined over the life of that machine."

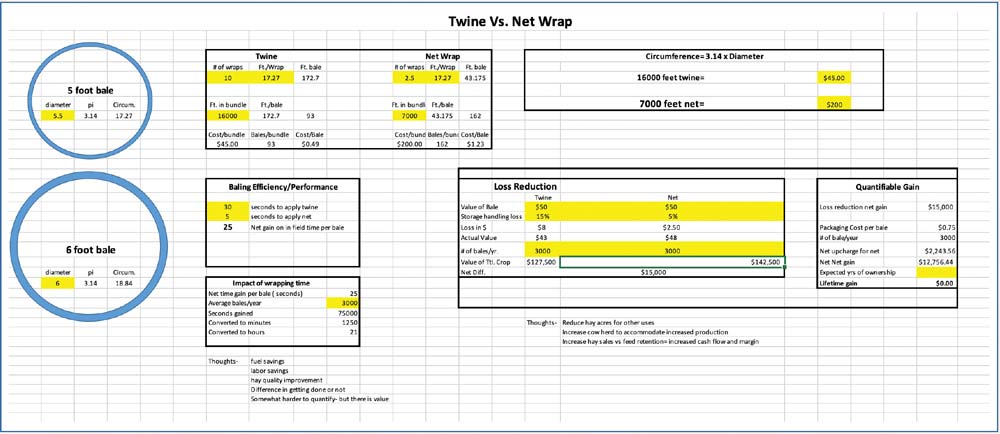

Morgan says, "The surest thing you can sell is something you can measure, something that's quantifiable, something you can put an exact value on." He uses an example of a ROI tool for twine vs. net wrap for bales.

"Whenever we're making the presentation to the customer and there may be some reluctance to make the extra $5,000, $6,000 or $7,000 investment in net wrap vs. twine, this is a tool where we can assess whether it's feasible or not. Is there going to be a good return on investment?" he says.

H&R Agri-Power's net wrap ROI tool looks at a few different aspects of the process and potential savings (See Fig. 2). First, the salesperson will enter in the numbers to determine how much wrapping the customer is going to use and what the relative cost per bale is whether twine or net wrap is used. "We've converted that to a cost per bale, whether it's 50 cents per bale with twine or $1.25 per bale with net," Morgan explains.

Fig. 2: H&R Agri-Power developed this ROI tool to show the benefits net wrap for bales can bring to a grower's bottom line. The tool helps demonstrate fuel and labor savings and hay quality improvements. It can also start a conversation about reducing hay acres for other uses or maybe the operator could increase sales vs. feed to increase cashflow and margin, explains Jeff Morgan, regional manager for the 17-store Case IH dealership. Click to enlarge photo

In this example, he also looks at efficiency in the field. Twine takes 30 second to apply, whereas the net wrap only takes 5 seconds with a net gain of 25 second per bale in the field. "So what could the customer have done with that other 21 hours that they saved while their tractor was sitting there putting twine on rather than baling hay or doing other things?," Morgan says.

"We get the fuel savings, the labor savings of it. You can quantify. If you've got a tractor sitting and running for 21 hours, it burned 21 hours of fuel. It also depreciated 21 hours. That's a real cost. And that customer had to pay someone to sit there."

That 21 hours of savings brings some opportunity costs and those discussions can be eye opening, Morgan says. "What if you just needed 30 minutes to finish up a hay field so you can move somewhere else before it rained. What was that worth? And that's when during the conversation the lights come on and the customer might say, 'Yeah, it's happened more often than not that I just got rained out and couldn't complete that task and it held me up to go forward to somewhere else.' So, there is value there. It's just a little harder to measure."

The ROI tool can also demonstrate an improvement in hay quality. The loss reduction section looks at the starting value of a bale ($50), any loss that comes from storage handling (in this example 15% for twine and 5% for net wrap), loss in dollars ($8 for twine vs. $2.50 for net), actual value ($43 for twine and $48 for net), number of bales per year (3,000) and the value of the total crop.

Web-Exclusive Sidebar:ROI & Agronomy — Find Your Spot in the Market

For twine, the total value comes out to $127,500, but as the tool shows using net brings the total value up to $142,500. That's a gain of $15,000. "You've more than doubled your investment the first year. That's a great ROI. There's not many things that we can double our investment on in a year's time," Morgan says. "And then, we can multiply that times the lifetime gain. If you're going to keep it 3, 4 or 5 years, that $6,000 could be worth $60 or $70,000 to you. So that's just one of the easier return on investments to sell."

Framing the Conversation

When Morgan is training salespeople he uses real situations the dealership has encountered. Sometimes it can be as simple as word choice. For example, a salesperson invited Morgan to join him in closing a deal against a competitive account. Prior to arriving at the customer's farm, Morgan says they rehearsed and he called attention to the difference between the words strength and weight when referring to the base weight of the combine. Weight can have a negative connotation if a farmer has wet ground. Rather than saying the combine is heavy, Morgan suggest saying "we've got 2,500 pounds of more built-in steel strength."

When doing a side-by-side comparison and looking at relative equivalencies it's hard to measure the difference between 300 and 315 bushels capacity or the difference between 360 horsepower from one unit to the other, he says. "We're presenting something that's the same as what a customer has got, except our cleaning area is larger than yours. I'm giving you a CVT drive, 6 belts instead of 20 belts and a quiet cab. After he demonstrated our combine, we looked at our spreadsheet tool. I said, 'Would you not agree our cleaning system is 1, 2, 3, 4 or 5 bushels better than what you're using now?' And he agreed, 'Yeah, I think you're 2 bushels better.' This was at a time when corn was really good. And he had 1,000 acres of corn."

Using an ROI tool, Morgan is able to show that even just a 2 bushel advantage translates to a $12,000 advantage over the competitive machine. Doing the same with soybeans, the customer said H&R's machine was 1 bushel better. Coupled together, that is $24,000 a year. If the customer keeps the combine for 3 years that is $72,000, using what Morgan says he thinks are fairly conservative numbers. In this situation, Morgan says they were able to close the deal with the customer, even though they were $10,000 higher on price than the competitor. Showing the ROI changed the narrative.

Demo Then ROI

For PrairieLand Partners, a 15- store John Deere dealership based in Kansas (2014 Dealership of the Year), an extensive demo program precedes any ROI discussions. Gudeman says they've had the most success working with ROI on the ExactEmerge planters, but at first they didn't realize the opportunity that existed for them with the planter.

"We're in central Kansas and while we have some places that raise a lot of corn, there's little irrigation. We have a fair amount of good old dryland wheat farmers and dryland corn farmers," he says. "At first we thought the technology wasn't for our customers. But then as we started to peel back the layers of what the technology can do, we really drew the line to ROI and knew we were onto something."

But first, PrairieLand had to show the planter to its customers. The dealership has committed 2 planters, 2 tractors and 2 employees to what Gudeman says is a significant demo program. The 2 employees spent the time with the machines so they could build up some expertise on the technology. Sales staff are part of the demo, but aren't responsible for operating the planter or showing 100% of the features and benefits. That is left to the demo employees.

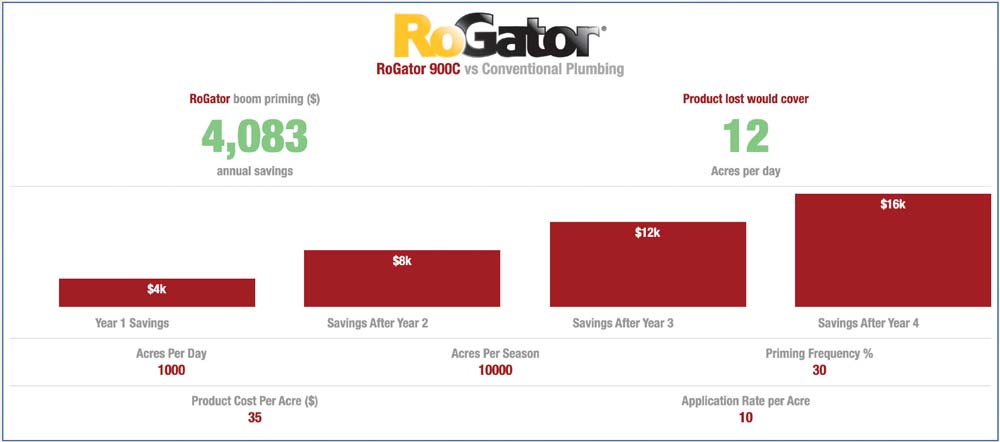

The AGCO Resource Center app makes ROI calculators available to both dealers and the public to help frame equipment purchase decisions. This example compares the ROI of a RoGator 900C vs. conventional plumbing. Click to enlarge photo

When PrairieLand gets to the customer's field, they split 80 acres with them — 40 acres with the dealership's planter and 40 acres with the customer's current planter. "We document all of it, we map it all and we try to get everything else about the same so we can measure the things that are important to emergence and coefficient of variation," Gudeman says. "How different is each seed spaced from one another. Those are the things that impact yield. And we would provide them with reports about how many seeds were used.

"When you look at ROI, are you going to look at is it affecting their expenses? Or is it affecting their revenue? Or you look at how you can impact their expenses. For example, if I plant exactly the number of seeds I'm supposed to."

On the revenue side, Gudeman says they look at how the technology can help the customer improve their yield and how uneven emergence can have a negative impact on yield. They will also highlight spacing. "We don't like to talk in superlatives and generalities and say, 'Oh, it's better.' It's like show me, show me."

In the fall, the team goes back to the customer's field and helps them combine, making sure yield monitors are set up correctly to get a good side-by-side comparison. "You've got to have the leadership, you've just got to have somebody to get behind it and just say, 'Hey, this is how we're going to do it.' And then go show your customers,' Gudeman says.

"The surest thing you can sell is something you can measure, something that's quantifiable, something you can put an exact value on…" ]

– Jeff Morgan, H&R Agri-Power

"I think the demo, the personal interaction, the contact with the customer, sets a stage and opens the door to have that conversation about his data at the end of the season," Gudeman says.

PrairieLand has also set up some of its own test plots and planted different populations and using that data they can show how someone can, for example, reduce their soybean population and keep their yield the same or even increase it in some places.

"We do a bunch of different samples of population size, and what that does is I'm reducing the number of seeds, so I'm managing my expenses. And in some cases, I'm improving my yield, which is going to take my return on investment and increase it," Gudeman says.

The dealership takes a team approach, with the salesperson playing quarterback but he has the support of the demo team, the precision staff and parts and service. This all ties into PrairieLand Partners strategy of selling value rather than being the low-cost equipment provider.

"It's harder to sell value. It takes more work. It takes more energy. But ultimately, we feel like that gives us a competitive advantage in a place that's not occupied by a lot of people."

Putting that data in front of the sales staff is critical, he says. "It's a whole lot easier when it's your own data. It's from across the street or maybe the customer knows the guy we worked with. You get better buy-in. Even though we can show them university studies, using their own numbers makes it more realistic," Gudeman says.

Related Content

- Defining Dealer-Customer Relationships of the Future with Dollars & Sense: Data-driven decision making and a 'CFO mentality' among next-generation farmers creates both opportunity and obstacles for dealerships

- Letting Math — Not Emotion — Drive Precision Purchasing Decisions: Creation of an ROI calculator, equipment optimization packages and a relationship-first approach to converting customer sales combine to put AgriVision Equipment's precision business on an innovative path.

- Putting Real Numbers into AgriVision's ROI Calculations: Jamie Brand, business development manager for AgriVision Equipment, says a key part of the ROI calculations the dealership provides to customers is taking into account the cost of ownership.

- Using ROI to Sell Customers on Strip-Till Management: H&R Agri-Power has created a strip-till feasibility calculator to help introduce customers to the practice.

- ROI & Agronomy — Find Your Spot in the Market: One of the keys to figuring out how to best incorporate agronomy services into your dealership is to determine your place in the market, says Paul Bruns, founder of Precision Consulting Services.

wayandonellove1988.blogspot.com

Source: https://www.farm-equipment.com/articles/18998-how-dealers-can-use-roi-to-sell-more-than-farm-equipment

0 Response to "Why is the Roi of a Harvesting Tractor Easy to Calculate"

Post a Comment